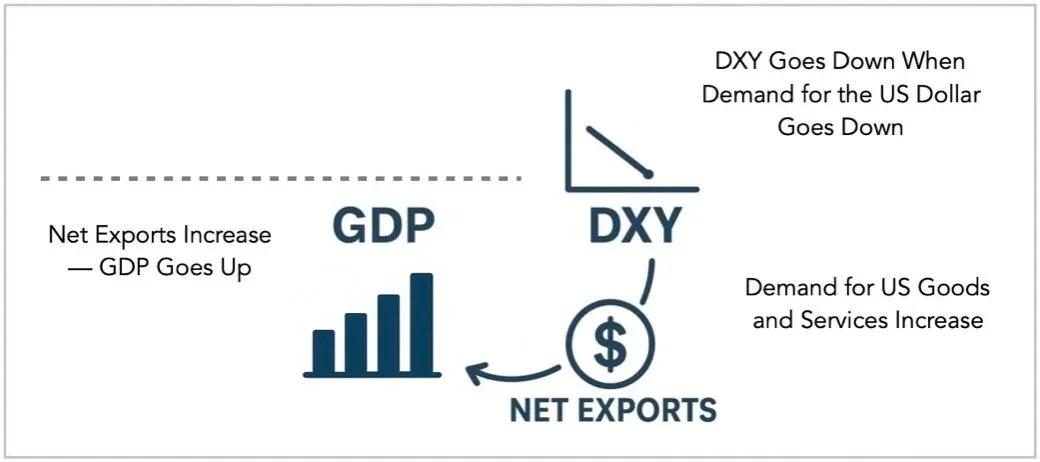

Each day brings new information about the US economy, contributing to an evolving understanding of economic conditions. Instead of characterizing the outlook as good or bad, economists typically focus on key performance indicators that may signal future trends. For example, net exports—the difference between the value of goods and services sold overseas and those purchased from abroad—can help project changes in GDP and is considered a performance measure. Relative prices can affect net exports, as shifts in the value of the dollar compared to other major currencies influence import and export demand. A decline in the dollar’s value generally makes imports more expensive and domestic products relatively less expensive, prompting consumers to favor domestic goods and services. Concurrently, lower-priced US goods and services may see higher demand internationally, increasing net exports and potentially raising GDP growth rates. As such, the US Dollar Index is regarded as a key performance indicator for GDP. In the current year, the US Dollar Index has declined by 9.52%. If all other factors remain constant, GDP could grow faster than if the index had not changed.

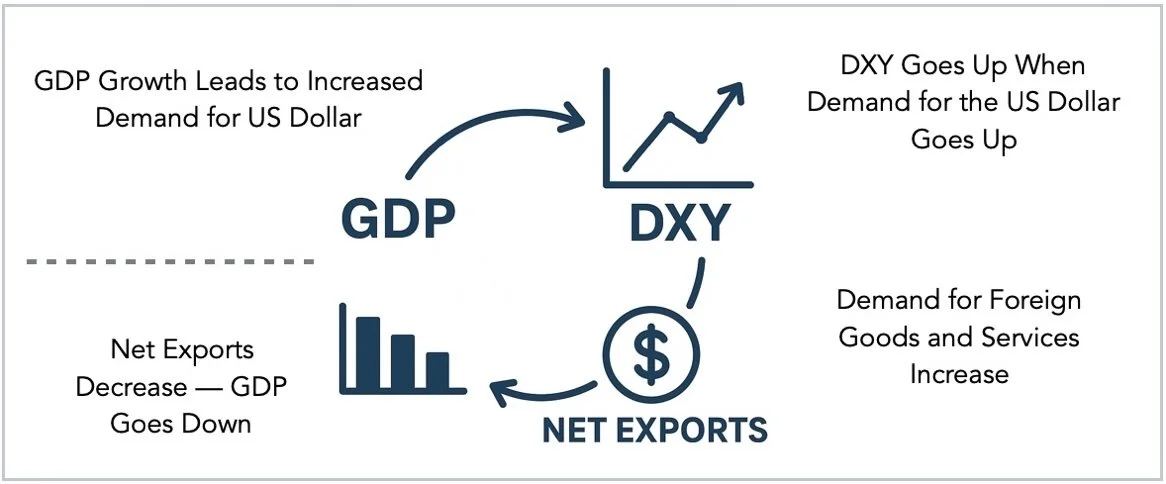

The US Dollar Index (DXY) fluctuates due to several factors. Faster growth in the US economy compared to its peers increases demand for goods and services, reducing inventories and unused capacities, which drives investment. The resulting greater need for investment funds tends to raise interest rates, sometimes prompting the Federal Reserve to adopt a more restrictive monetary policy to address inflationary pressures. Higher interest rates can attract global capital seeking better returns, boosting demand for US dollars. This shift raises the dollar’s relative value. In 2022, strong US growth and Federal Reserve rate hikes led to DXY climbing above 110, reaching a 20-year high.

In summary, robust GDP growth can lead to increased returns and demand for the US dollar, higher Federal Reserve rates, and a stronger USD, which may shift demand toward foreign goods and services and result in weaker GDP. The relationship between GDP, DXY, and net exports tends to be cyclical; changes in one often influence the others over time. These cycles can be expansionary or contractionary depending on various factors in both US and foreign economies, as well as governmental responses.

Currently, the DXY has decreased by nearly 10% in 2025, which might suggest prospects for further GDP growth. However, multiple additional factors must be considered. For example, recently implemented tariffs are expected to raise the price of foreign goods relative to US goods, potentially supporting GDP growth if there are no counter tariffs. Conversely, higher prices for consumers may reduce overall spending, leading to an estimated GDP contraction of 0.5% to 1.5%. Reduced GDP may translate to lower labor demand and higher unemployment. In response, the Federal Reserve may ease monetary policy by lowering interest rates or purchasing bonds, which would likely decrease dollar demand and further reduce the DXY. Over time, adjustments among GDP growth rate, DXY, and net exports move toward a new equilibrium, though ongoing reactions from consumers, governments, and central banks can introduce further shocks into the cycle.

The bottom line is that based on the current status of the GDP-DXY-Net Exports-GDP cycle the US GDP growth rate will be lower next year than this year. While predicting the direction of change is relatively easy, predicting the magnitude of that change is more difficult especially given the ease at which the Federal Reserve and the current Administration can influence the cycle.